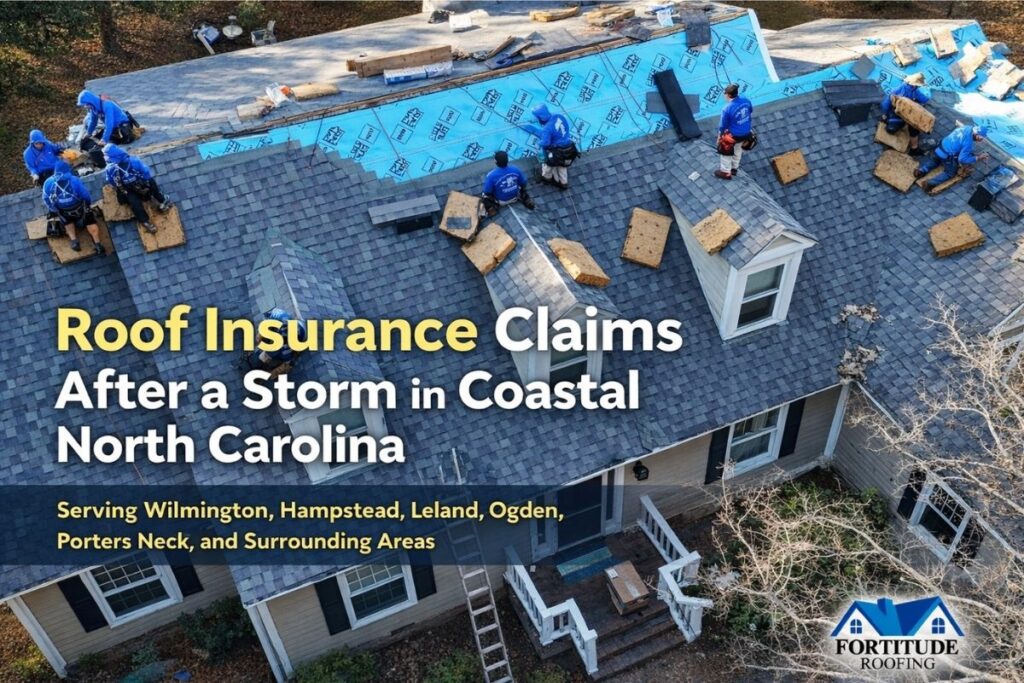

Roof Insurance Claims After a Storm in Coastal North Carolina

Roof Insurance Claims After a Storm in Coastal North Carolina

Serving Wilmington, Hampstead, Leland, Ogden, Porters Neck, and Surrounding Areas

Storm damage to roofs is common in Coastal North Carolina. Getting an insurance company to fully recognize that damage is not always straightforward. Homeowners in Wilmington, Hampstead, Leland, Ogden, Porters Neck, and nearby coastal communities often face denied or underpaid roof insurance claims after hurricanes, tropical storms, and severe wind events.

Knowing how the claim process works—and how to document damage correctly—can materially improve your odds of approval and proper coverage.

Quick Answer: What Should You Do After Storm Damage to Your Roof?

After a storm in Coastal North Carolina, homeowners should act quickly:

- Schedule a professional roof inspection

- Document visible exterior and interior damage (photos/video)

- File the claim within policy deadlines

- Be present for the adjuster inspection and ensure all slopes/areas are reviewed

- Compare the insurance estimate to a contractor’s documented scope (code items, flashing, underlayment, ventilation)

In coastal areas, documentation quality and local construction expertise often determine whether a claim is approved, underpaid, or denied.

What to Do After Storm Damage to Your Roof in Coastal NC

If your roof may have been impacted:

- Do not delay (late action can weaken documentation and create causation disputes)

- Schedule a professional roof inspection

- Document visible damage even if there are no leaks

- File your claim promptly and keep written records

- Have a local roofing contractor present during the adjuster inspection when possible

This is especially important in Coastal North Carolina, where wind-driven rain, uplift pressure, and salt exposure create damage patterns insurers frequently underestimate.

Why Roof Insurance Claims Are Often Underpaid in Coastal North Carolina

1) Storm Damage Isn’t Always Obvious

High winds and pressure changes can compromise:

- shingles (creases, lifted edges, broken seals)

- underlayment and water barriers

- flashing and penetrations

- fasteners and attachment points

This damage may not create immediate leaks, and it’s often missed without a construction-trained inspection and proper documentation.

2) Adjusters Are Not Roofing Specialists

Adjusters interpret policy language and estimate repairs, but many are not coastal roofing experts. Without a qualified local contractor involved, legitimate storm damage may be incorrectly classified as:

- normal wear and tear

- deterioration

- pre-existing conditions

3) Coastal Building Codes Can Drive Scope and Cost

Roof repairs and replacements in coastal counties often require enhanced wind-related standards. If the claim scope does not account for code-required items, homeowners can face:

- uncovered scope gaps

- project delays

- out-of-pocket costs to bring the roof to compliance

A claim estimate that ignores code realities is often not a buildable scope.

How the Roof Insurance Claim Process Works in North Carolina

Step 1: Professional Roof Inspection

A licensed local roofing contractor inspects for wind, hail, and water intrusion and documents findings with:

- photos

- measurements

- notes aligned to insurance estimating logic

The goal is to capture storm-related damage clearly and defensibly.

Step 2: File the Insurance Claim

The homeowner opens the claim with the carrier and receives:

- a claim number

- next steps and timeframes

Most policies require prompt reporting. Keep a log of calls/emails.

Step 3: Adjuster Inspection

The insurance adjuster inspects the property. Best practice in Coastal NC:

- be present

- ensure all roof areas are reviewed

- have your contractor present for construction observations when possible

This reduces missed damage and scope disputes.

Step 4: Claim Review, Estimate, and Settlement

The insurer issues an estimate for repair or replacement. In coastal claims, it is common to need:

- clarification of scope

- additional documentation

- supplements for hidden damage and code items

The estimate is often the beginning of scope alignment—not the final word.

Does Home Insurance Cover Roof Damage From Storms in NC?

In many cases, yes. Most North Carolina homeowner policies cover sudden, accidental storm damage, such as:

- hurricane and tropical storm wind damage

- high winds and wind-driven rain intrusion

- hail (when applicable)

Insurance typically does not cover:

- normal wear and tear

- poor installation

- long-term neglect or slow leaks

The core issue is cause of loss (storm event vs. aging). That is why documentation matters.

How Fortitude Roofing Helps With Roof Insurance Claims

Fortitude Roofing is a local Coastal North Carolina roofing company specializing in storm damage and insurance-related restoration for homeowners in Wilmington and surrounding communities.

We support homeowners by:

- performing insurance-grade roof inspections

- providing photo and measurement documentation

- identifying code-required items that affect buildability

- attending adjuster inspections for construction observations

- ensuring repairs/replacements meet local wind and building requirements

We do not work for insurance companies. We support homeowners with clarity and construction expertise.

FAQ: Roof Insurance Claims After a Storm in Coastal NC

Should I file a claim if my roof isn’t leaking?

Often, yes. Wind damage can exist without immediate leaks and can worsen over time.

How soon should I inspect my roof after a storm?

As soon as conditions are safe. Early inspection protects documentation and timelines.

Can insurance deny my claim because my roof is old?

Coverage is based on cause of loss, not age. Older roofs often require stronger documentation to distinguish storm damage from wear.

Do I need a local contractor for coastal roof claims?

In most cases, yes. Local experience with coastal wind patterns and code realities materially improves scope accuracy and documentation quality.

Areas We Serve

Fortitude Roofing assists homeowners with roof insurance claims across:

- Wilmington, NC

- Hampstead, NC

- Leland, NC

- Ogden

- Porters Neck

- Wrightsville Beach

- Surf City

- Surrounding Coastal North Carolina communities

Schedule a Local Roof Inspection After a Storm

If your home was impacted by a recent storm—or you’re unsure whether damage exists—don’t wait for leaks to appear or deadlines to pass.

Schedule a professional roof inspection with Fortitude Roofing to protect your home, your insurance benefits, and your long-term investment.