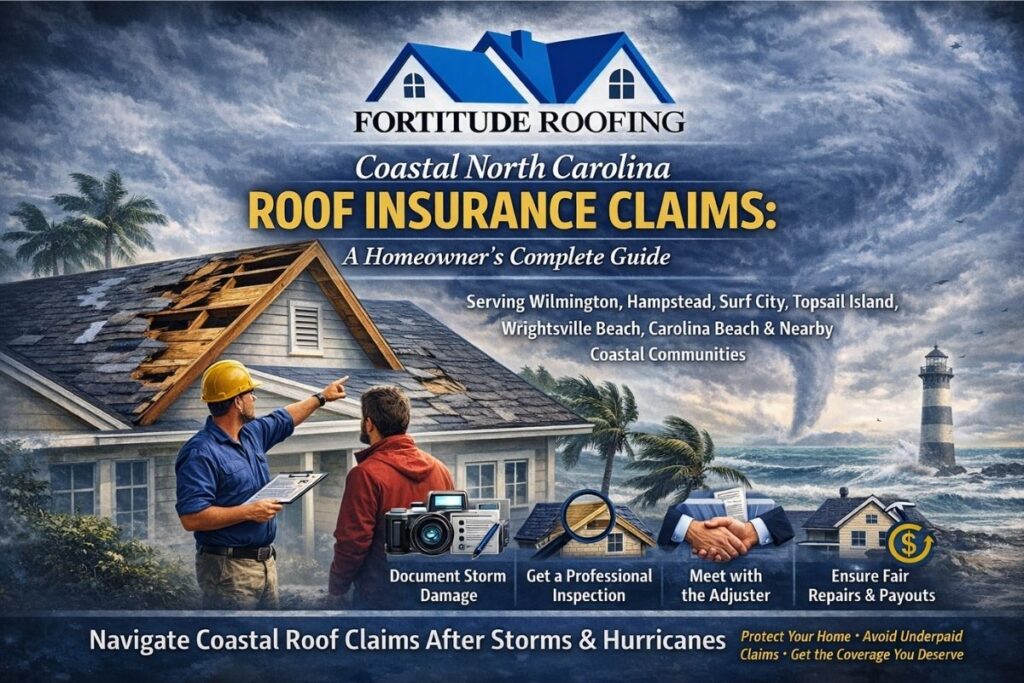

Coastal North Carolina Roof Insurance Claims: The Complete Homeowner Guide

Serving Wilmington, Hampstead, Surf City, Topsail Island, Wrightsville Beach, Carolina Beach, and Nearby Coastal Communities

If you live on the North Carolina coast, filing a roof insurance claim after a storm can feel confusing and high-risk. Carriers often scrutinize coastal claims more aggressively due to frequent hurricanes, tropical storms, and high-wind events.

This guide explains how roof insurance claims work in Coastal North Carolina, what insurers look for, where homeowners commonly get stuck, and how to protect yourself from underpaid or denied claims after wind or storm damage.

Quick Answer: How Do Roof Insurance Claims Work in Coastal North Carolina?

A coastal roof insurance claim typically follows this sequence:

- Document storm damage quickly (photos/video, exterior + interior)

- File the claim within your policy’s deadlines

- Schedule a professional roof inspection (ideally before the adjuster visit)

- Meet the insurance adjuster (ideally with your contractor present for construction observations)

- Review the insurance estimate carefully (scope, code items, underlayment, flashing, labor)

- Resolve scope gaps via supplements when the estimate doesn’t match real construction requirements

- Schedule repairs or replacement after approval

In coastal markets, documentation quality + local construction/code expertise often determines whether a claim is approved, underpaid, or denied.

Why Roof Insurance Claims Are Different Along the NC Coast

Roof claims in coastal areas (including New Hanover, Pender, and Brunswick County markets) tend to be evaluated differently because homes face:

- Strong sustained winds and wind uplift pressure

- Wind-driven rain intrusion

- Salt-air deterioration (accelerated wear on components)

- Higher frequency of named storms

As a result, insurers may:

- Scrutinize causation more aggressively

- Attribute storm damage to “wear and tear”

- Push for repairs instead of full replacement even when system integrity is compromised

This is why local coastal roofing experience matters—especially for documenting how damage occurred and what is required to restore the roof to compliant, functioning condition.

What Roof Damage Is Typically Covered by Insurance in North Carolina?

Most homeowner policies cover sudden, accidental storm-related damage. Common covered scenarios include:

- Wind damage from hurricanes/tropical storms

- Missing, lifted, or creased shingles caused by wind

- Punctures from flying debris or fallen limbs

- Interior water damage when it results from a storm-created roof opening

Common exclusions (often not covered) include:

- Normal aging/deterioration

- Poor maintenance

- Long-term or slow leaks

- Pre-existing damage not caused by the reported storm event

Key concept: insurance is generally designed for storm events, not expected aging.

Step-by-Step: How to File a Roof Insurance Claim in Coastal NC

Step 1: Check for Storm Damage (Even If It’s Not Obvious)

Coastal storms commonly cause damage that homeowners don’t see from the ground, including:

- Lifted/creased shingles

- Compromised flashing around chimneys/vents/walls

- Subtle wind damage that worsens over time

If you wait too long, carriers may argue the damage is unrelated—or worsened due to delay.

Step 2: Document Everything Immediately

Before cleanup (when safe), capture:

- Photos and video of the roof (from safe vantage points)

- Missing shingles, lifted areas, and damaged flashing

- Interior stains, wet drywall, damp attic insulation

- The storm date and event name (if applicable)

Strong documentation reduces disputes about when and how the damage occurred.

Step 3: Get a Professional Coastal Roof Inspection Before the Adjuster Visit

A licensed, local coastal roofing contractor can:

- Identify storm-related damage patterns

- Distinguish storm damage vs. aging-related wear

- Provide photo documentation and a construction-based scope

- Flag code-related requirements and system components insurers often omit

This step often determines whether a claim is properly scoped or underpaid.

Step 4: File the Claim and Create a Paper Trail

When you contact the carrier:

- Report the storm event

- Obtain a claim number

- Confirm next steps and timeline

- Keep written notes of each call (date/time/name/summary)

Step 5: Meet the Insurance Adjuster (Do Not Treat This as Routine)

Best practice in coastal NC:

- Be present for the adjuster inspection

- Have your contractor present for construction observations

- Ensure all slopes, penetrations, and accessories are reviewed

Adjusters can miss or undervalue damage—especially subtle wind-related issues—without construction context.

Step 6: Review the Insurance Estimate Like a Scope of Work

Insurance estimates commonly under-scope coastal roof work by omitting or minimizing:

- Code-related line items and high-wind requirements

- Underlayment system needs

- Flashing details (walls, chimneys, valleys, penetrations)

- Labor realities and material requirements

Compare the carrier estimate to your contractor’s documented scope. If the scope doesn’t restore the roof correctly, it’s not a complete estimate.

Step 7: Resolve Scope Gaps Through Supplements (Common in Coastal Claims)

If your contractor identifies missing items required to perform code-compliant work, supplements may be needed.

Important framing: supplements should be construction-based (what is required to do the job correctly), not emotional or adversarial.

Repair vs. Full Roof Replacement in Coastal North Carolina

Insurance may approve:

- Repairs when damage is isolated and the system remains sound

- Replacement when damage is widespread, system integrity is compromised, or code requirements are triggered

Common coastal reasons replacement is justified:

- Wind uplift damage patterns across multiple slopes

- Inability to match existing shingles/materials

- Code-driven requirements for high-wind performance and system integration

How Long Do Roof Insurance Claims Take in North Carolina?

Typical timeframes (varies by storm volume and carrier):

- Claim filing: ideally within 1–2 days once safe

- Adjuster inspection: often 3–14 days

- Estimate review + supplements: commonly 1–3 weeks

- Construction scheduling: after approval, dependent on material availability and weather

The most common causes of delay:

- Weak documentation

- Adjuster inspection completed without contractor input

- Incomplete or under-scoped estimates requiring supplements

What If Your Roof Insurance Claim Is Denied?

Common denial reasons include:

- “Wear and tear” determination

- Pre-existing damage

- Insufficient documentation

- Dispute about whether the reported storm caused the damage

Practical next steps:

- Review the denial letter and stated reason

- Gather additional evidence (photos, inspection report, moisture findings)

- Request a reinspection if justified

- If appropriate, consult a licensed public adjuster or attorney for claim strategy

Many coastal denials can shift when documentation clearly supports storm causation and required scope.

Common Mistakes Coastal Homeowners Make With Roof Claims

Avoid these high-cost errors:

- Filing a claim before getting a professional inspection

- Letting the adjuster inspect alone

- Making permanent repairs too early (before documentation/approval)

- Accepting the carrier estimate without a scope review

- Hiring out-of-area storm chasers with no local accountability

These mistakes frequently lead to underpaid claims and out-of-pocket costs.

Why Local Coastal Roofing Experience Changes Outcomes

Coastal NC roof claims often hinge on details that generic contractors miss:

- High-wind installation requirements

- Coastal moisture and ventilation realities

- Carrier behavior patterns in hurricane-prone markets

- Proper documentation of wind-related functional damage and system scope

Local experience helps ensure the claim is evaluated against what’s actually required to restore performance—not a minimal patch.

How Fortitude Roofing Helps Coastal North Carolina Homeowners

Fortitude Roofing supports homeowners in Wilmington, Hampstead, Surf City, Topsail Island, Wrightsville Beach, Carolina Beach, and surrounding coastal communities with:

- Storm damage roof inspections

- Photo documentation suitable for insurance review

- Construction-focused scope development

- Adjuster coordination for on-site observations

- Code-compliant coastal roof replacement when warranted

Schedule a Coastal Storm Damage Roof Inspection

If your home has experienced wind, hurricane, or storm activity, the most important first step is knowing what damage exists before coverage decisions are made.

What you can expect with Fortitude Roofing:

- No-cost, no-obligation storm damage inspection

- Coastal-specific assessment based on wind and code realities

- Photo documentation organized for claim clarity

- Direct guidance on whether filing a claim makes sense

There is no pressure to file a claim and no obligation to proceed with repairs. The priority is clarity, documentation, and protecting your home.