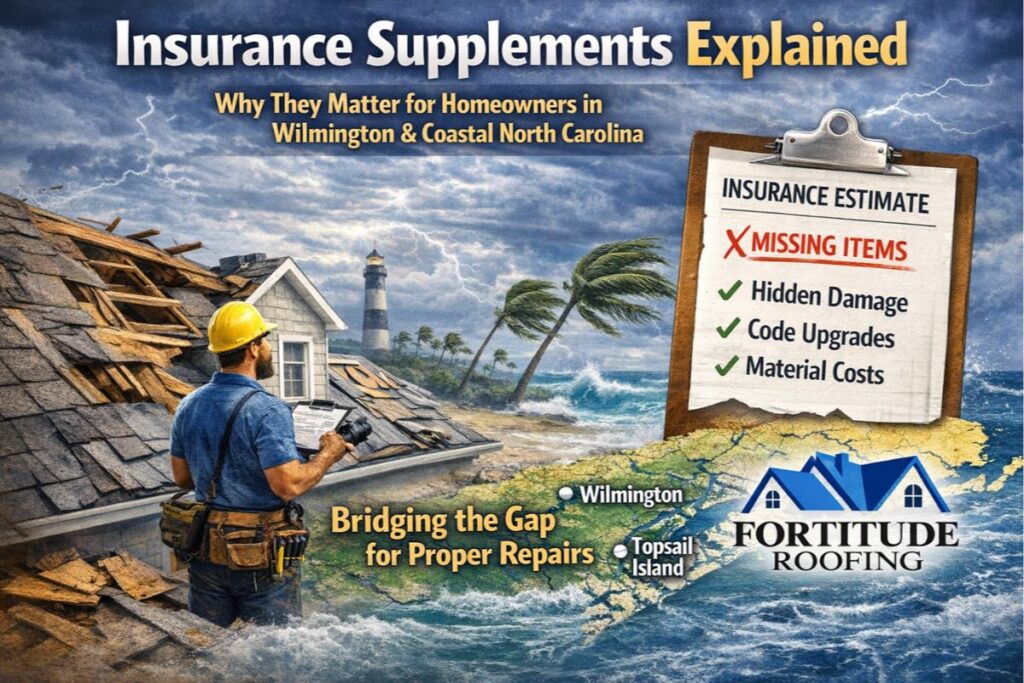

Insurance Supplements Explained: Why They Matter for Homeowners in Wilmington and Coastal North Carolina

Insurance Supplements Explained: Why They Matter for Homeowners in Wilmington and Coastal North Carolina

If you own a home in Wilmington or along the Coastal North Carolina shoreline, there’s a good chance you’ll face an insurance claim at some point—especially after hurricanes, tropical storms, hail, or high-wind events.

One of the most misunderstood (and most important) parts of that process is the insurance supplement.

Homeowners often assume the insurance estimate is final—then discover mid-project that critical materials, repairs, or code requirements were never included. That gap is exactly why supplements exist.

Quick Answer: What Is an Insurance Supplement?

An insurance supplement is a formal, documented request sent to the insurance carrier when the original insurance estimate does not cover the full, necessary scope of repairs.

Supplements typically address:

- Items discovered after tear-off (hidden damage)

- Code-required upgrades

- Differences between estimating software assumptions and real construction requirements

In plain terms:

- The adjuster’s estimate is often a starting point

- The full scope becomes clear once work begins

- Supplements align the claim to what’s required for a code-compliant, proper repair

This is especially common in Wilmington and Coastal North Carolina, where storm damage can be subtle, progressive, and governed by stricter coastal building standards.

Why Insurance Supplements Are Common in Wilmington and Coastal NC

Supplements are normal in coastal storm restoration. They are not automatically “upselling” and they are not a red flag.

They are especially common across:

- Wilmington

- Leland

- Hampstead

- Surf City

- Topsail Island

- Carolina Beach

- Wrightsville Beach

- Jacksonville

- New Hanover, Pender, and Brunswick Counties

Common Coastal Reasons Supplements Are Needed

- Hidden wind uplift damage that doesn’t show clearly during initial inspection

- Water intrusion discovered after tear-off

- Roof decking damage (common in older coastal homes)

- Code-required items triggered by the repair scope

- Material pricing/availability shifts post-storm

- Estimating software line items that don’t match coastal construction realities

Key point: adjusters do visual estimating; contractors perform actual teardown and build. Those are not the same job, and the difference matters.

What Do Insurance Supplements Typically Cover?

A properly documented supplement may include:

- Additional roofing materials

- Replacement of damaged roof decking

- Updated labor requirements based on actual conditions

- Code-required upgrades (often underlayment, ventilation, edge details)

- Flashing replacement (chimneys, walls, valleys, penetrations)

- Disposal/haul-away costs not correctly scoped

- Manufacturer-required installation details for warranty compliance

- Related trade work when impacted (gutters, fascia, siding, ventilation components)

In a coastal environment, these items aren’t “nice-to-have.” They often determine whether the roof performs long term.

Why Homeowners Should Care (Even If Insurance Is Paying)

A common assumption is: “If insurance approved it, it must be enough.”

That assumption can produce expensive outcomes:

- Incomplete repairs

- Corners cut to fit an under-scoped estimate

- Out-of-pocket costs later

- Premature roof failure

- Voided manufacturer warranties

- Code compliance issues

A contractor who avoids supplements may be optimizing for speed and simplicity—not accuracy. Supplements, when legitimate, protect the homeowner’s outcome.

Who Handles Insurance Supplements?

In most cases, the roofing contractor should handle supplements—not the homeowner.

A competent contractor should:

- Document conditions thoroughly (photos, measurements, notes)

- Produce a construction-based scope that matches real requirements

- Justify code-related items with appropriate references (as needed)

- Communicate professionally with the carrier/adjuster

- Keep the homeowner informed without putting them in the middle

Homeowners shouldn’t be expected to “argue construction scope” with an insurer. That’s the contractor’s lane.

Are Insurance Supplements Legitimate?

Yes—when done correctly.

Insurers know that additional findings often appear once work begins. Supplements exist because initial estimates are based on limited visibility and standardized assumptions.

What separates legitimate supplements from noise:

- Accurate documentation

- Code knowledge and local installation standards

- Ethical pricing

- Professional, construction-based communication

This is where local coastal experience in the Wilmington market makes a meaningful difference.

Why Local Coastal Experience Matters in Wilmington and Beach Communities

Coastal NC homes face:

- Higher wind exposure and uplift risk

- Salt-air corrosion

- Stricter code expectations and installation requirements

- Older roof assemblies with hidden substrate issues

- Complex roof geometry common near the coast

A contractor unfamiliar with local conditions may miss legitimate damage—or fail to justify necessary scope—leading to underpaid claims, delays, or repairs done “to fit the estimate” rather than to protect the home.

Key Takeaway for Wilmington and Coastal NC Homeowners

Insurance supplements exist to help ensure:

- Your roof is repaired correctly

- Work is code-compliant and warranty-aligned

- Insurance benefits match the real scope required

- Your long-term investment is protected

If a contractor insists supplements “aren’t necessary” in a coastal storm claim, that’s not automatically wrong—but it should prompt a direct question:

“Are you repairing the roof correctly—or repairing it to fit the initial estimate?”

FAQ: Insurance Supplements in Wilmington and Coastal North Carolina

Do insurance supplements delay my claim?

Handled properly, supplements are a normal part of the process and often prevent bigger delays caused by incomplete scope or rework.

Can insurance deny a supplement?

Carriers may request more documentation. Legitimate, well-supported supplements are frequently approved—especially when tied to code and verified conditions.

Will I pay more if a supplement is needed?

Supplements are intended to cover necessary repairs. Your cost typically remains governed by your deductible and policy terms (unless items fall outside coverage).

Should I approve repairs before supplements are resolved?

Ideally, no. Work should reflect the full, approved scope to avoid shortcuts, disputes, or incomplete restoration.

Need Help With an Insurance Claim in Wilmington or Coastal NC?

If you’re dealing with:

- A denied or underpaid claim

- Storm, wind, or hurricane damage

- Questions about your insurance estimate

- A contractor unwilling to handle supplements

Fortitude Roofing supports homeowners across Wilmington and Coastal North Carolina with insurance-focused inspections and restoration services—built for coastal conditions and long-term performance.

Service Areas: Wilmington | Leland | Hampstead | Surf City | Topsail Island | Carolina Beach | Wrightsville Beach | Jacksonville | Surrounding Coastal North Carolina Communities