What “Normal Wear and Tear” Means in Roof Insurance Language

What “Normal Wear and Tear” Means in Roof Insurance Language

If you’ve ever heard an adjuster say, “That’s normal wear and tear,” you’re not alone—and you’re not wrong to feel confused. Homeowners often assume the phrase means “anything old.” Insurance companies use it differently: wear and tear is gradual deterioration, and most policies are designed to cover sudden, accidental events (like wind or hail from a specific storm), not long-term aging.

This guide explains how insurers generally define normal wear and tear, how it differs from storm damage, and why the distinction matters for homeowners across coastal North Carolina—including Carteret, Craven, Onslow, Pender, Brunswick, and New Hanover counties.

Fortitude Roofing serves homeowners across coastal NC, including Wilmington, Hampstead, Surf City, Jacksonville, Morehead City, Beaufort, Emerald Isle, Leland, Southport, and Oak Island.

Quick Answer: What Does “Normal Wear and Tear” Mean for Roof Insurance?

In insurance terms, normal wear and tear typically means expected roof deterioration that happens slowly over time due to age and exposure—rather than damage caused by a specific storm or sudden event.

Insurance is more likely to cover roof damage when you can document:

- a specific date/event,

- a sudden change in condition, and

- damage patterns consistent with wind uplift and/or hail impact.

Plain-English translation: insurance is built for events, not maintenance.

How Insurers Use the Term “Wear and Tear”

Insurance companies generally classify wear and tear as non-covered because it is predictable and ongoing. The roof may still need repair or replacement—but the cause matters.

Common “wear and tear” examples insurers cite:

- Granule loss from aging (asphalt shingles thinning over time)

- Brittleness from UV exposure (heat/sun cycles causing cracking and fragility)

- Sealant degradation (adhesives failing over time and temperature swings)

- Long-term moisture exposure (slow leaks, chronic ventilation issues, recurring condensation)

A carrier may acknowledge the roof needs replacement and still deny coverage if they determine the primary driver is deterioration rather than a sudden loss event.

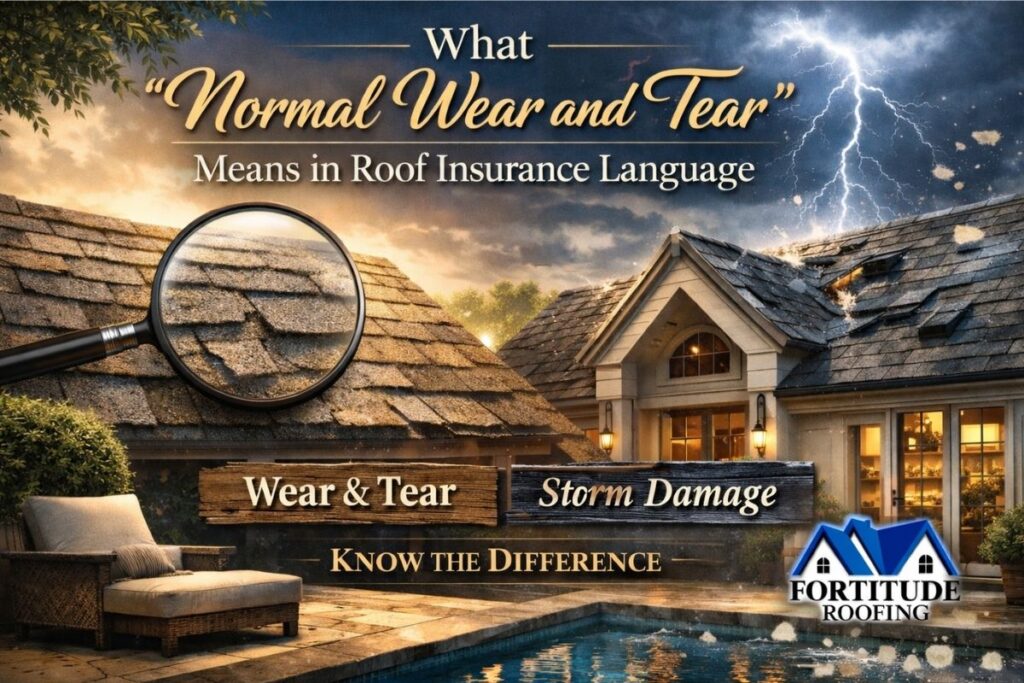

Wear and Tear vs. Storm Damage: The Real Difference

Wear and tear is typically:

- gradual,

- expected with age,

- widespread and relatively uniform,

- hard to tie to a single date.

Storm damage is typically:

- sudden or meaningfully accelerated by a specific event,

- often directional (wind) or impact-based (hail),

- reasonably tied to a storm date and weather history,

- visible in recognizable patterns consistent with wind uplift or hail strikes.

Important point: An older roof can still have legitimate storm damage. Age doesn’t automatically disqualify a claim—but it usually raises the documentation standard.

Why This Distinction Matters in Coastal North Carolina

In markets like Morehead City, Beaufort, Emerald Isle, Atlantic Beach, Swansboro, Jacksonville, Surf City, Hampstead, Wilmington, Leland, Southport, and Oak Island, storms are frequent enough that many roofs show a mix of:

- legitimate storm impact, and

- age-related deterioration.

When you file a claim, the insurer is usually trying to answer three questions:

- Did the damage occur suddenly?

- Can it be tied to a specific storm date?

- Does it exceed what they consider normal aging for this roof type and age?

If a claim cannot clearly answer those, carriers often default to “wear and tear” and deny coverage—even when storm damage is present.

Common Misunderstandings That Cost Homeowners Money

1) “My roof is old, so insurance won’t cover it.”

Not always true. Storm damage can still be covered on older roofs if the claim establishes storm causation, not just age.

2) “Any roof damage is wear and tear.”

Also false. “Wear and tear” is sometimes used broadly, but many storm claims succeed when the damage pattern supports an event and the evidence is clear.

3) “Cosmetic damage doesn’t matter.”

Often incomplete. “Cosmetic” is not always the same as “non-functional.” Some policies restrict cosmetic coverage, but appearance-related damage can still affect water shedding performance, lifespan, and manufacturer requirements depending on severity and material type.

Documentation: The Make-or-Break Factor (Especially on Older Roofs)

If storm damage exists, outcomes often depend on whether you can present a clear narrative supported by evidence.

What typically helps most:

- photos showing a “before vs after” change (even imperfect),

- date-stamped leak photos or interior staining progression,

- a professional roof evaluation with labeled photos and slope-by-slope notes,

- storm timeline: date of event + relevant weather reports (wind/hail, if applicable),

- evidence of collateral damage (gutters, downspouts, soft metals, screens, vents).

What typically hurts most:

- waiting too long after the storm,

- filing without a roof inspection,

- mixing multiple storm dates without a clear claim strategy,

- assuming the adjuster will “find it” without documentation.

A Practical North Carolina Example

A homeowner in Wilmington or Emerald Isle may have a 14–18-year-old architectural shingle roof. After a high-wind event, they notice a leak. The carrier may respond: “This roof is old—wear and tear.”

What changes the outcome is whether the inspection documents storm-consistent findings and ties them to the storm date—for example:

- wind-related lifting, creasing, displaced tabs, or broken seals,

- missing shingles or exposed fasteners,

- impact patterns consistent with hail (where applicable),

- slope-by-slope distribution that matches wind direction and exposure.

The goal is to separate event-driven damage from generalized deterioration.

What to Do Next (Before You File or If You’ve Been Denied)

If you suspect storm damage but you’re hearing “wear and tear,” use a disciplined process:

- Pick the storm date you’re anchoring the claim to (avoid blending multiple events).

- Document the roof by slope: wide shots + close-ups of specific indicators.

- Document the interior (leaks/staining) with dates and progression.

- Request a professional evaluation with labeled photos and a written narrative.

- Build a storm timeline (event date + relevant weather reporting).

- Include collateral damage evidence (soft metals, gutters, vents, screens).

- Submit a clean evidence package focused on causation and restoration feasibility.

If insurance is involved, the winning argument is almost never “my roof is old.” It’s “this condition changed due to a defined event, and the evidence supports that.”

FAQs

Does homeowners insurance cover an old roof in North Carolina?

It can. Insurance may cover storm-related damage on an older roof if the damage can be tied to a specific event and documented clearly. Age alone is not always a valid denial reason, but it often increases scrutiny.

What is considered “wear and tear” on a roof?

Wear and tear is gradual deterioration from time and exposure—such as granule loss, UV brittleness, sealant failure, and long-term moisture effects—rather than sudden storm damage.

Can a roof be both worn out and storm damaged?

Yes. Many roofs in coastal NC show both. Insurance decisions often come down to whether storm damage can be separated from normal aging through inspection evidence tied to a storm date.

Should I get a roof inspection before filing a claim?

In most cases, yes. A professional evaluation can clarify whether damage is storm-related or age-related and help prevent avoidable denials based on incomplete documentation.

Why do insurers default to “wear and tear” so often?

Because wear and tear is a common exclusion and it’s difficult to prove causation without a storm date, pattern-consistent damage evidence, and clear documentation of a sudden change in condition.

Final Takeaway

Understanding how insurers interpret “normal wear and tear” helps you approach roof claims realistically and avoid preventable denials. Storm damage on an older roof can still be covered, but the deciding factor is usually documentation and causation, not roof age.

If you’re unsure whether your roof damage is age-related or storm-related, a professional evaluation can clarify the difference before you file—especially in coastal North Carolina where roofs often show mixed conditions.

Fortitude Roofing Service Area (Coastal NC)

Fortitude Roofing serves homeowners across coastal North Carolina, including Carteret, Craven, Onslow, Pender, Brunswick, and New Hanover counties—such as Wilmington, Hampstead, Surf City, Jacksonville, Morehead City, Beaufort, Emerald Isle, Leland, Southport, and Oak Island.

Author and Review

Reviewed by: Fortitude Roofing (Coastal NC)

Educational content only. Coverage depends on policy language, endorsements, and carrier determinations.